In a bold proclamation that has sent ripples through the financial establishment, Eric Trump has staked his reputation on the demise of traditional banking—unless it embraces cryptocurrency within the next decade.

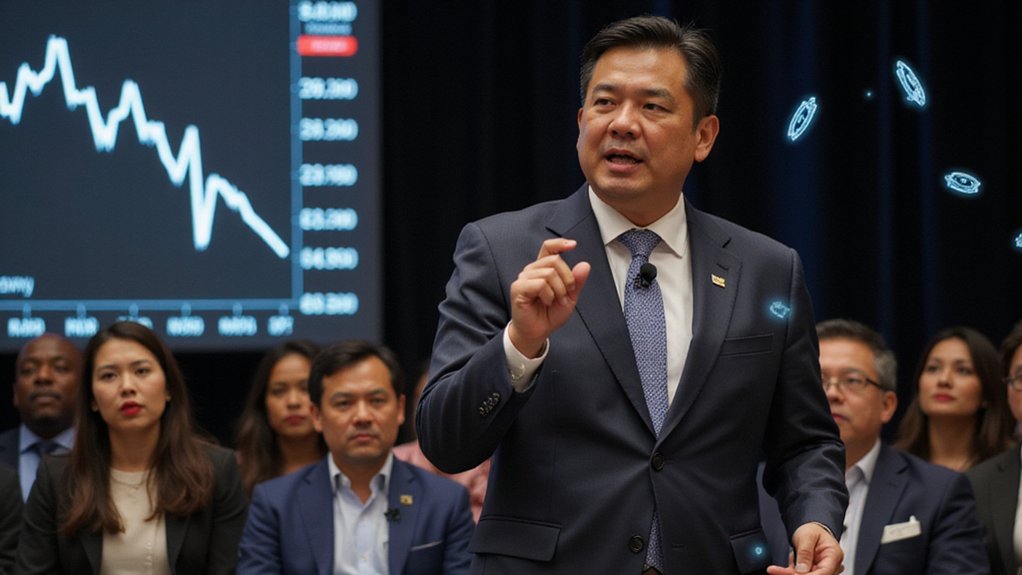

Speaking at industry events throughout spring 2025, Trump has characterized the contemporary banking system as “absolutely broken,” while forecasting Bitcoin’s meteoric rise to $1 million—a valuation that would fundamentally restructure global financial hierarchies.

Banking is broken beyond repair. Bitcoin will soar to $1M, completely redefining the world’s financial power structure.

The former president’s son has positioned the venerable SWIFT system—that creaking infrastructure of international transfers—as a relic destined for obsolescence.

The inefficiencies appear indefensible: why tolerate days-long settlement periods and exorbitant fees when cryptocurrency networks offer near-instantaneous transactions at a fraction of the cost?

Such comparative advantages form the cornerstone of Trump’s extinction-level warning to banks refusing cryptocurrency integration.

His evangelism coincides with the March 2025 launch of USD1, a Trump-linked stablecoin built on BNB Chain and purportedly backed by short-term treasuries and cash equivalents.

Beyond Bitcoin and stablecoins, Trump has highlighted Ethereum and Solana as critical blockchain infrastructures that will revolutionize financial services through their advanced capabilities.

This timing has raised eyebrows, particularly following Wall Street Journal allegations of arrangements between the Trump family and Binance to revive its U.S. operations—claims both parties vehemently deny.

Institutional response has been predictably mixed.

While the Bank of Italy has voiced skepticism toward stablecoins generally, crypto executives attending Token2049 have enthusiastically endorsed Trump’s timeline for banking’s crypto pivot.

The prediction’s credibility derives partly from accelerating institutional adoption amid pro-crypto U.S. policy shifts following the 2024 election.

As Vice President of the Trump Organization, Eric Trump’s business acumen adds weight to his cryptocurrency predictions, which many industry insiders see as more than just speculative commentary.

Trump’s scheduled appearances at the May 2025 Bitcoin Conference alongside Donald Trump Jr. further cement his position as cryptocurrency’s unexpected establishment champion.

His core argument—that global financial competitiveness now requires crypto infrastructure—resonates with both libertarian enthusiasts and pragmatic financiers.

Whether prophecy or promotional strategy for USD1, Trump’s prediction reflects cryptocurrency’s inexorable mainstreaming.

For traditional banks, the calculus becomes increasingly stark: adapt to the decentralized paradigm or risk becoming the financial equivalent of Blockbuster in a streaming world.