Within months of launching World Liberty Financial during his 2024 presidential campaign, Donald Trump and his family have accumulated a crypto fortune that exists primarily in the ephemeral domain of digital tokens—22.5 billion WLFI tokens to be precise, currently valued at approximately $5 billion on paper (assuming, of course, that “on paper” carries much meaning in a market where prices can plummet 48% in two days).

The Trump family’s corporate entity controls a commanding 60% stake in World Liberty Financial, with Donald Trump initially holding the rather theatrical title of “Chief Crypto Advocate” before shifting to the more diplomatically palatable “Co-Founder Emeritus”—a designation that conveniently includes provisions for removal upon taking office.

One might wonder whether emeritus status in cryptocurrency carries the same gravitas as it does in academia, though the answer likely depends on token performance.

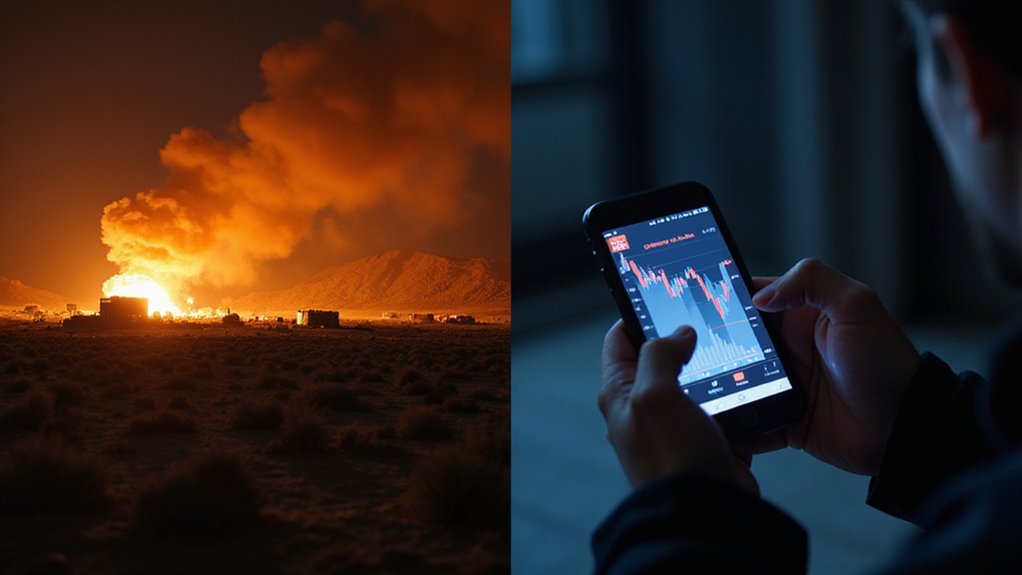

WLFI’s market debut followed the predictable trajectory of speculative digital assets: an exuberant spike to nearly 40 cents before reality intervened, settling the token around 23 cents. This volatility presents a fascinating paradox where the Trump family’s fortune oscillates wildly based on trader sentiment regarding a venture that launched amid heightened political scrutiny. Despite market turbulence, institutional adoption continues to strengthen across various cryptocurrency sectors as regulatory frameworks become clearer.

The timing proves particularly intriguing, given Trump’s evolution from crypto skeptic to vocal advocate coinciding precisely with his presidential ambitions. His administration’s stated goal of positioning America as a global crypto hub creates an interesting dynamic when the incoming president’s family holds billions in digital assets subject to regulatory frameworks his administration will oversee. Trump has already signed the Genius Act, representing the first major federal legislation addressing cryptocurrency regulation.

Watchdog groups and Democratic lawmakers have raised predictable concerns about conflicts of interest, while the White House denies any ethical complications. Expert commentary during financial news segments has highlighted the unprecedented nature of a presidential family’s direct involvement in cryptocurrency ventures.

World Liberty Financial, meanwhile, has declined comment on these accusations—a response that speaks volumes about the complexities of maneuvering politics and cryptocurrency simultaneously.

The founding team’s tokens remain locked under an undetermined vesting schedule, though investors approved selling up to 20% of holdings after launch. This liquidity restriction means the Trump family’s crypto fortune exists in a state of theoretical wealth, valued by markets that demonstrate remarkable capacity for both euphoria and despair within remarkably compressed timeframes.