While the blockchain industry continues its relentless pursuit of the next paradigm-shifting infrastructure—a quest that has produced more ambitious whitepapers than practical applications—Subzero Labs emerges with Rialo, a platform that dares to prioritize mundane concerns like developer experience and real-world utility over the typical crypto evangelism of revolutionary disruption.

Founded by Ade Adepoju and Lu Zhang, both early engineers at Mysten Labs who contributed to the Sui network, the venture represents a curious convergence of battle-tested Web2 expertise and Web3 ambitions. Zhang’s pedigree spans Meta’s ill-fated Diem project and AI/ML infrastructure development at both Meta and Google, while Adepoju brings distributed systems experience from Netflix and advanced microchip design credentials from AMD—credentials that suggest actual engineering competence rather than merely theoretical blockchain enthusiasm.

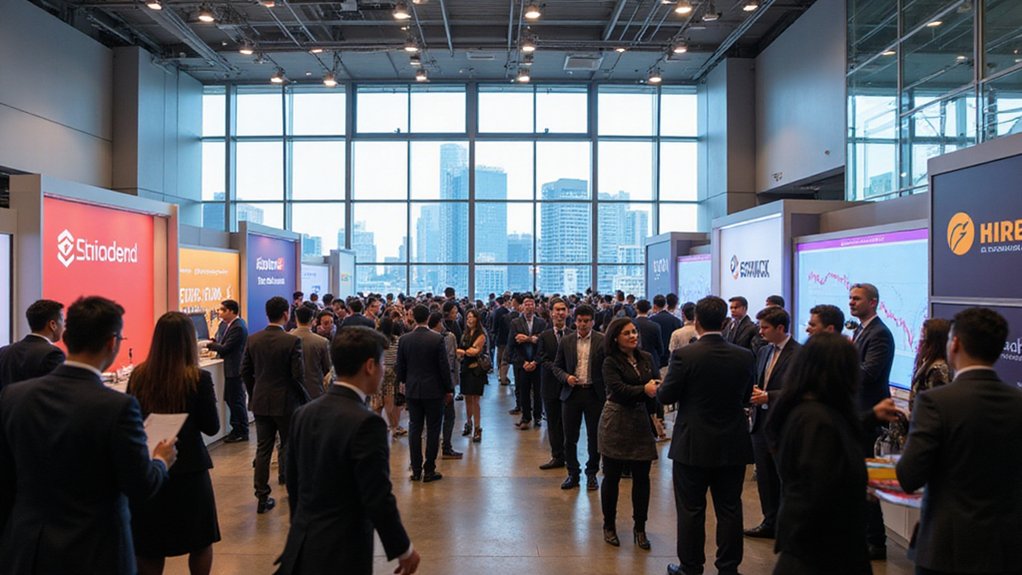

The company’s recent $20 million seed round, led by Pantera Capital with participation from Coinbase Ventures, Variant, and a constellation of prominent institutional investors, closed in Q1 2025 with both equity and token warrants. This funding structure reflects growing investor sophistication in maneuvering the regulatory uncertainties that continue to plague token offerings. The success demonstrates the market’s continued institutional adoption despite broader economic pressures affecting the cryptocurrency landscape.

Rialo’s architecture represents what the founders describe as a “radical rethinking” of decentralized programmable networks, incorporating native web connectivity, event-driven transactions, and integrated privacy features. Unlike conventional blockchain classifications, Rialo defies traditional layer categorization entirely, positioning itself as a fundamentally different approach to distributed infrastructure. The platform leverages RISC-V architecture alongside Solana VM compatibility to enable deployment of existing programs while unlocking advanced capabilities. The platform aims to eliminate the infrastructure constraints that have historically made decentralized applications feel like clunky approximations of their centralized counterparts—a problem that has persisted despite years of “Ethereum killer” promises.

The team, assembled from talent across Meta, Apple, Amazon, Netflix, Google, and various crypto protocols, appears focused on bridging the gap between Web2 scalability expectations and Web3 architectural realities. Their emphasis on real-world data integrations and responsiveness comparable to traditional web applications suggests an understanding that developer adoption requires more than theoretical throughput metrics.

Whether Rialo can deliver on its promise to support “internet-scale decentralized apps” remains to be seen, but the substantial institutional backing and founders’ track record suggest this isn’t merely another speculative venture trading on blockchain buzzwords. The platform’s success will ultimately depend on whether developers embrace infrastructure that prioritizes practical utility over ideological purity.