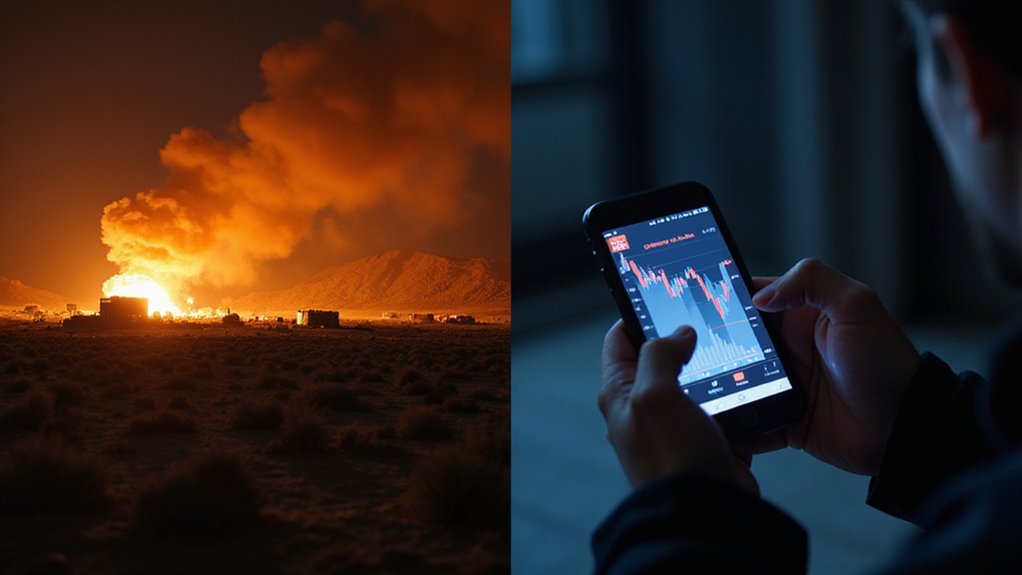

While geopolitical tensions have historically sent traditional markets into predictable tailspins, the cryptocurrency sector‘s reaction to Tuesday’s U.S. airstrikes on Iranian nuclear facilities demonstrated just how thoroughly digital assets have embraced the time-honored Wall Street tradition of panic selling.

Within hours of the military action, $595 million in crypto long positions evaporated, dragging more than 172,000 traders into liquidation territory—a mass capitulation event that would make even seasoned equity veterans wince.

The scale of trader liquidations reached levels that would humble even Wall Street’s most battle-hardened veterans.

The carnage proved democratically distributed across the digital asset ecosystem. Bitcoin, despite clinging to its perch above $102,000, compressed into an uncomfortable trading range between $101,500 and $104,000, forming what analysts diplomatically termed a “liquidity sweep setup” (translation: brace for impact).

Ethereum abandoned all pretense of stability, plummeting over 5% to breach $2,300 for the first time in a month, while dragging the broader DeFi ecosystem down with it.

Altcoins, predictably, bore the brunt of the selling pressure. Cardano shed nearly 6%, approaching three-month lows, while AI-related tokens like FET and VIRTUAL—previously the darlings of speculative fervor—suffered near double-digit declines.

Solana joined the exodus, demonstrating that even the most battle-tested layer-1 protocols remain hostage to geopolitical whiplash.

The liquidation mechanics revealed the crypto market’s structural vulnerabilities with uncomfortable clarity. Total liquidations exceeded $670 million, with the largest single position—a $9.15 million Ethereum long on HTX—serving as a particularly expensive reminder that leverage cuts both ways. The Fordow, Natanz, and Isfahan facilities that came under direct attack represent the core of Iran’s nuclear infrastructure, amplifying market fears about prolonged regional instability.

The crypto market’s total capitalization contracted 2% to $3.15 trillion, proving that digital assets remain remarkably sensitive to traditional geopolitical catalysts despite their decentralized ethos. Market analysts are now tracking the probability of Iran blocking the Strait of Hormuz, which has surged to 52% following the strikes.

President Trump’s promise of escalated military response to any Iranian retaliation has traders positioning defensively, creating a feedback loop where geopolitical uncertainty breeds market volatility, which in turn amplifies trader anxiety. Despite ongoing challenges including market volatility and regulatory compliance, the sector continues to mature as it moves from speculation toward tangible utility.

The crypto sector’s reaction suggests that for all its revolutionary rhetoric about financial independence, digital assets remain stubbornly correlated with old-fashioned human emotions—particularly fear.