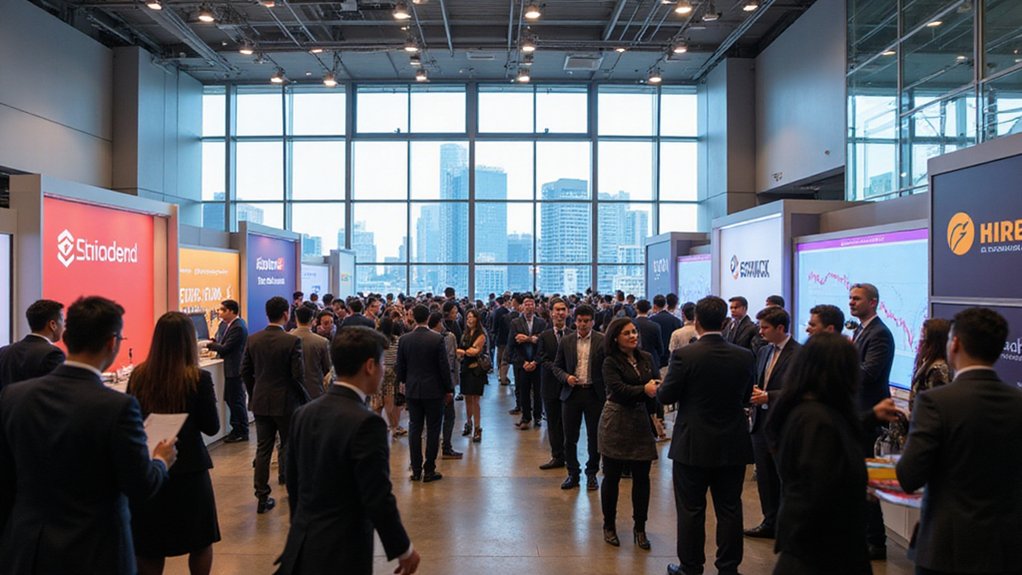

A silent revolution is unfolding across the digital asset landscape as cryptocurrency firms set out on an unprecedented hiring spree that reflects both market maturation and strategic positioning for future growth cycles.

With Bitcoin touching the heady heights of $97,000 and the total market capitalization reaching $3.12 trillion, industry players are scrambling to secure talent that can navigate this increasingly complex ecosystem. The most notable shift? Legal, policy, and ecosystem roles—once peripheral concerns—now occupy center stage in recruitment strategies.

As digital assets reach unprecedented valuations, the race for regulatory talent signals crypto’s evolution from disruptor to institutional mainstay.

Former regulators and policy wonks are trading their government credentials for lucrative positions at crypto firms, bringing invaluable regulatory insights to an industry perpetually dancing on the knife-edge of compliance. Meanwhile, pseudonymous builders—those digital-native talents who cut their teeth in the trenches of early protocols—are emerging from the shadows to assume formal positions, a clear indication of the industry’s evolving appreciation for crypto-specific expertise.

The numbers tell a compelling story: Bureau of Labor Statistics projections indicate a 22% surge in blockchain developer demand by 2025, substantially outpacing other technology sectors. Job postings related to cryptocurrency have skyrocketed by 118% year-over-year, as blockchain technology permeates industries far beyond its financial origins. The new GENIUS Act could further accelerate hiring in stablecoin sectors as companies rush to meet 1:1 reserve requirements and prepare for independent audits. Indeed, analysts project that over 10% of global GDP could find itself tokenized and stored on blockchain infrastructure by year’s end—a staggering prospect with profound implications for workforce development.

The DeFi sector, growing at a projected CAGR of 42.7% through 2028, presents particularly fertile ground for employment opportunities. Companies are increasingly seeking professionals with expertise in DeFi protocols including liquidity pools, staking mechanisms, and DEX infrastructure. This hiring surge aligns with predictions that institutional adoption will drive significant market growth despite ongoing regulatory challenges. Specialists in decentralized finance protocols and NFT ecosystems are commanding premium compensation packages as firms position themselves to capitalize on these rapidly expanding markets.

This hiring frenzy, unlike previous cycles, exhibits remarkable geographic diversity, with no single region dominating the talent acquisition landscape. Instead, we’re witnessing a global redistribution of intellectual capital, as blockchain expertise becomes essential across finance, healthcare, and supply chain management worldwide—an inflection point that may well redefine professional mobility for decades to come.