Amid Kenya’s rapidly evolving financial landscape, where mobile money platforms like M-Pesa have already revolutionized traditional banking paradigms, Binance’s commanding 43.8% global market share positions the cryptocurrency exchange as an increasingly formidable force in shaping the country’s digital asset ecosystem.

The platform’s staggering $4.4 trillion annual trading volume in 2023—though admittedly down from the previous year’s $5.2 trillion—dwarfs most competitors and creates liquidity pools that inevitably influence local crypto markets.

The exchange’s 29.5 million funded accounts as of October 2023 underscore its penetration into emerging markets, with Kenya representing a particularly strategic frontier. This massive user base generates trading volumes that can reach $76 billion in peak 24-hour periods, creating market dynamics that smaller, locally-focused exchanges struggle to match.

The sheer scale raises questions about market concentration: when one platform commands such dominance, does genuine competition become a quaint notion?

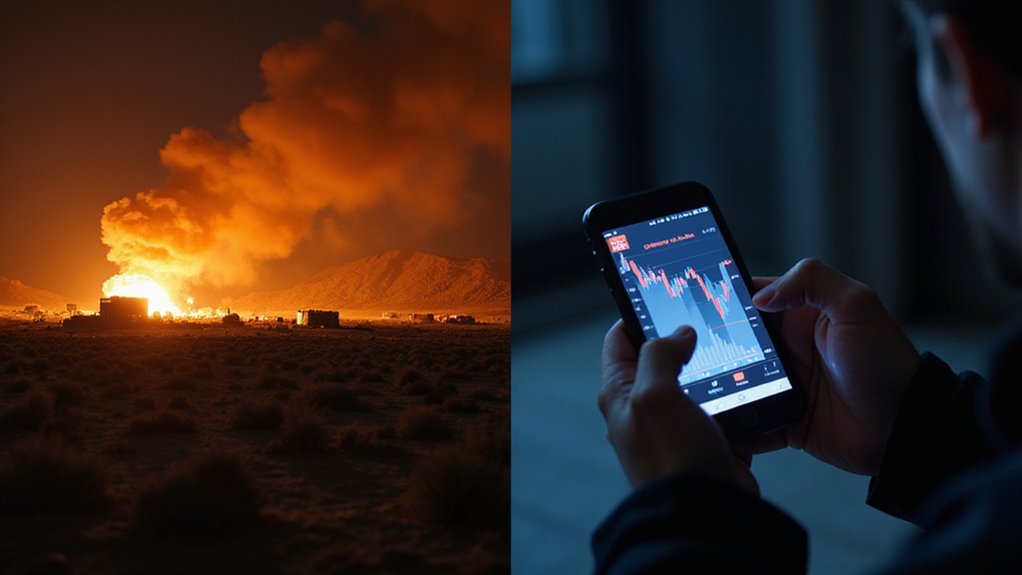

Binance’s regulatory journey—characterized by scrutiny followed by compliance investments—mirrors the broader tension between innovation and oversight plaguing the crypto sector. As the industry transitions from speculation to tangible utility, exchanges like Binance must navigate increasingly complex regulatory landscapes while maintaining their market positions.

The delicate dance between crypto innovation and regulatory oversight continues to define the sector’s turbulent maturation process.

Kenya’s evolving regulatory framework must grapple with an entity that generated $16.8 billion in revenue during 2023 (a 40% year-over-year increase, no less), while simultaneously attempting to foster domestic fintech development. Founded by Changpeng Zhao in 2017, the exchange has evolved from a Hong Kong startup to a global financial powerhouse that regulatory authorities worldwide must now carefully consider.

The platform’s market share fluctuations tell their own story: dropping from 62% in 2022 to 30% by late 2023, only to rebound strongly in 2024. Such volatility suggests that while Binance’s influence appears unassailable, regulatory pressure and competitive forces can create meaningful shifts—albeit temporarily. The exchange’s BNB token reached an all-time high of $710 by June 2024, demonstrating the platform’s continued financial strength despite regulatory challenges.

For Kenya’s crypto ecosystem, Binance’s presence represents both opportunity and challenge. The exchange’s educational initiatives and technological infrastructure contribute to market development and job creation, yet its dominance potentially crowds out local competitors.

The platform’s accessibility through web and mobile applications democratizes crypto trading, but this convenience comes with the implicit acceptance of a foreign entity’s outsized influence over domestic digital asset markets.

Whether this constitutes unfair market dynamics or simply reflects the natural evolution of global financial systems remains Kenya’s regulatory puzzle to solve.