In what can only be described as another breathtaking display of AI market exuberance, Anthropic has catapulted its valuation to a staggering $183 billion following a $13 billion Series F funding round led by Iconiq Capital—a figure that not only triples the company’s March 2025 valuation of $61.5 billion but also positions this OpenAI rival as the fourth-most valuable startup globally.

The financing attracted an almost comically diverse consortium of institutional heavyweights, from Fidelity Management and BlackRock to sovereign wealth funds like Qatar Investment Authority and private equity titans including Blackstone. When pension funds and sovereign wealth entities start throwing billions at AI startups with the enthusiasm of venture capitalists discovering the next unicorn, one might reasonably wonder if we’ve entered an entirely new paradigm of capital allocation—or simply witnessed institutional FOMO at unprecedented scale.

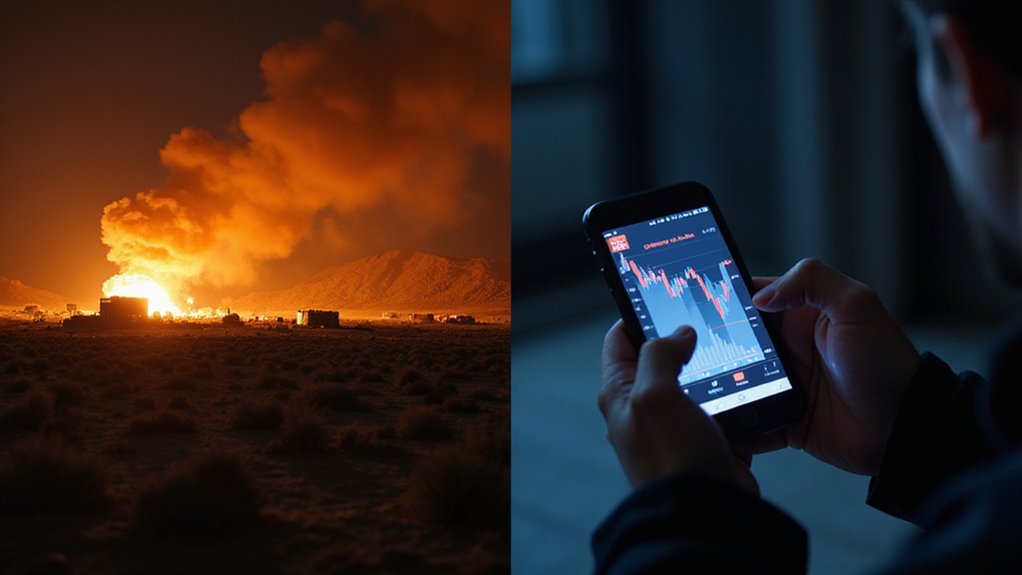

Anthropic’s meteoric ascent rests on more than mere market hysteria, however. The company’s annual revenue run rate surged from approximately $1 billion in early 2025 to $5 billion by August, driven primarily by explosive API adoption and enterprise integration. Claude Code alone generates over $500 million in run-rate revenue, experiencing 10x usage growth within three months—numbers that would make even seasoned growth investors pause in admiration. The surge in enterprise adoption coincides with the rise of AI integration in cryptocurrency markets, where enhanced transaction efficiencies and security protocols are creating new revenue streams for AI-powered platforms.

The enterprise momentum appears particularly robust, with approximately 300,000 business customers now utilizing Anthropic’s products. More tellingly, large enterprise accounts generating over $100,000 in annual revenue have increased nearly sevenfold within twelve months, suggesting genuine enterprise adoption rather than speculative dabbling. The company’s recognized expertise in coding capabilities has become a crucial differentiator in attracting high-value enterprise clients seeking specialized AI solutions. The company has allocated resources strategically across enterprise adoption, safety research initiatives, and international expansion efforts to sustain this growth trajectory.

This funding round’s composition reveals institutional confidence that extends beyond traditional venture capital risk appetites. When asset managers, pension funds, and sovereign wealth entities collectively deploy $13 billion into a single AI company, they’re fundamentally wagering that Anthropic’s technical capabilities and safety-focused approach will capture meaningful market share in what many consider the defining technological race of the decade.

Whether this $183 billion valuation represents prescient recognition of transformative technology or spectacular overvaluation remains the trillion-dollar question. Given the current trajectory of AI development and enterprise adoption rates, investors appear increasingly comfortable with the former interpretation.