A handful of visionary entrepreneurs have transformed the cryptocurrency landscape from a fringe experiment into a multi-trillion-dollar ecosystem that now commands the attention of institutional investors, central banks, and regulators worldwide. These digital moguls have wielded blockchain technology with remarkable precision, creating financial instruments that would have seemed fantastical just two decades ago.

Vitalik Buterin stands as perhaps the most intellectually formidable figure in this space, co-founding Ethereum and releasing smart contracts upon an unsuspecting financial world. His platform now powers thousands of decentralized applications, proving that programmable money wasn’t merely a computer scientist’s fever dream.

Meanwhile, Changpeng Zhao transformed Binance from startup to exchange behemoth in eight months—a timeline that makes traditional financial institutions appear glacially slow by comparison.

The Winklevoss twins, having parlayed their Facebook settlement into crypto prominence, launched Gemini with an almost obsessive focus on regulatory compliance. Their approach proved prescient as institutional investors demanded the security and transparency that wild-west exchanges couldn’t provide. This emphasis on legitimacy helped shepherd corporate treasuries toward cryptocurrency adoption.

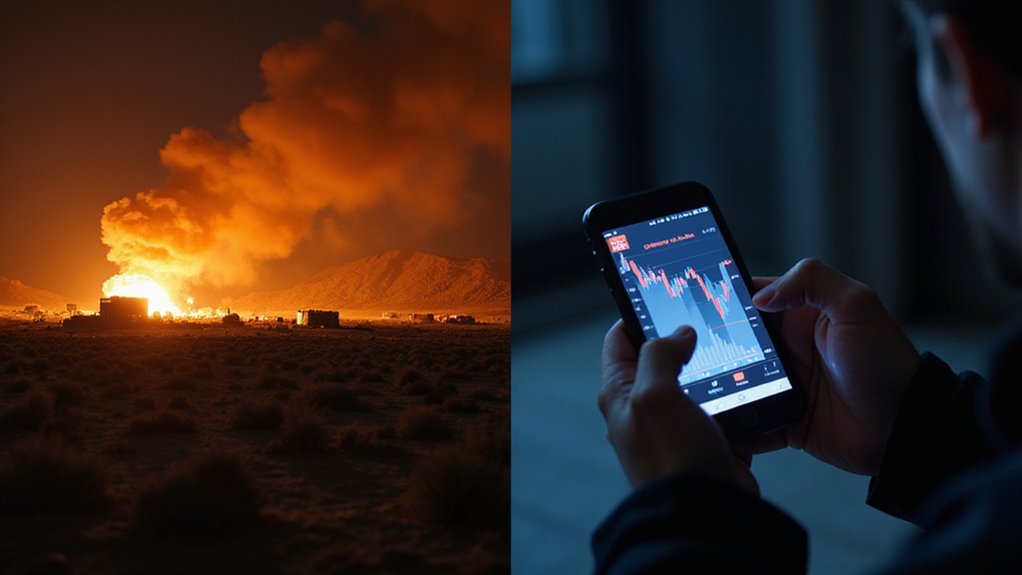

Michael Saylor deserves particular recognition for his audacious treasury strategy at MicroStrategy, converting corporate cash reserves into Bitcoin—a move that either represents visionary leadership or spectacular corporate gambling, depending on market conditions. His public evangelism for Bitcoin as a reserve asset has influenced countless other executives to reconsider their cash management strategies.

These leaders have also demonstrated remarkable philanthropic instincts. Buterin’s billion-dollar donation to COVID relief efforts showcased cryptocurrency’s potential for rapid, borderless charitable impact, while Binance’s Charity Foundation has deployed nearly $16 million supporting 145,000 individuals globally.

Perhaps most notably, these tycoons have embraced regulatory engagement rather than antagonism. Binance’s implementation of Proof of Reserves disclosures and Gemini’s compliance-first approach signal an industry maturation that extends far beyond mere profit maximization. As regulatory clarity continues to develop, many experts predict an increasingly favorable environment for cryptocurrency growth and institutional adoption. Jesse Powell’s Kraken achieved the distinction of being the first Bitcoin exchange to display trading prices on Bloomberg Terminal, marking a significant milestone in cryptocurrency’s integration with traditional financial infrastructure. The industry now operates across nearly 550 exchanges, demonstrating the massive scale and fragmentation that characterizes today’s cryptocurrency marketplace.

Their collective influence has legitimized digital assets as serious financial instruments, transforming speculative tokens into institutional-grade investments that now occupy central bank balance sheets and corporate treasuries worldwide.