While skeptics have spent years dismissing cryptocurrency as a speculative bubble destined for irrelevance, 2024 delivered a rather inconvenient truth: global crypto adoption surged by 172%, bringing the total number of digital asset owners to an estimated 559 million people—roughly 6.9% of the world’s population who have apparently decided that traditional finance alone isn’t quite cutting it.

The demographics tell a fascinating story about generational financial rebellion. Millennials and Gen Z are leading this charge, with higher-income users displaying greater adoption tendencies—though one might wonder if correlation implies causation or simply disposable income for experimental asset classes. Global surveys reveal that 58% of consumers are either holding crypto (21%) or harboring crypto-curious intentions (37%), suggesting the movement extends far beyond early adopters into mainstream consciousness.

Geographic patterns reveal intriguing disparities in adoption motivations. India leads global adoption rates, followed by Nigeria and Indonesia—emerging markets where crypto addresses financial inclusion gaps that traditional banking systems have neglected. Meanwhile, the United States ranks fourth, with Vietnam claiming fifth place, indicating that crypto appeal transcends both economic development levels and regulatory environments.

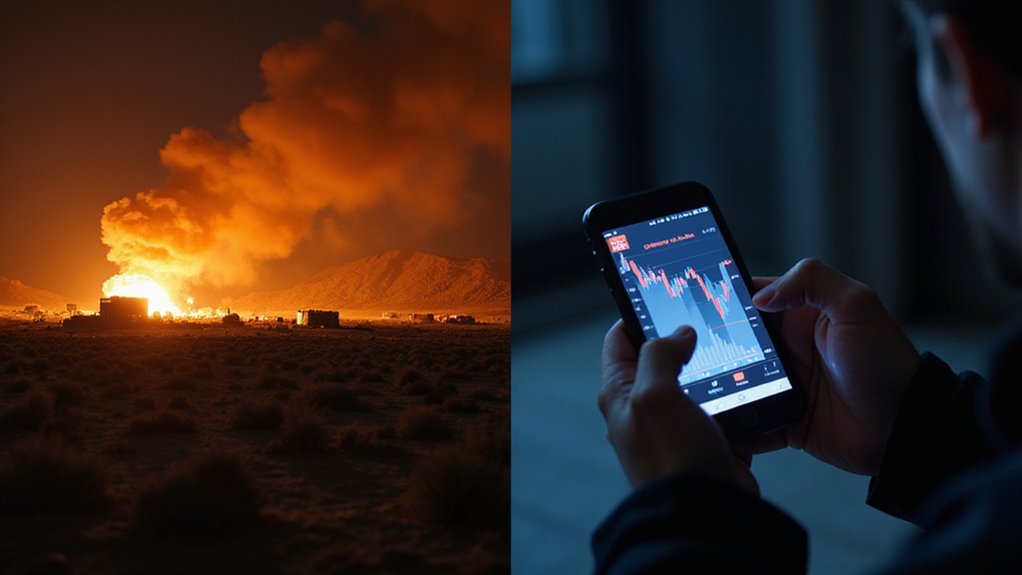

The institutional landscape is experiencing seismic shifts that would have seemed fantastical mere years ago. The Trump administration’s initiatives, including a Strategic Bitcoin Reserve and favorable SEC leadership changes, have transformed regulatory uncertainty into cautious optimism. Legislative frameworks like the GENIUS/CLARITY Acts, combined with Bitcoin ETF approvals, are facilitating institutional participation at unprecedented scales. The latest data reveals that crypto ETF ownership among US investors climbed to 39%, demonstrating growing institutional confidence in regulated digital asset products. This regulatory clarity from governments is fostering a supportive environment for businesses and individuals to enter the cryptocurrency space.

Technology evolution is reshaping crypto’s utility beyond speculative investment. Decentralized Finance (DeFi) platforms are expected to surpass centralized exchanges, while stablecoins serve as bridges between traditional finance and digital assets. Tokenized real-world assets are revolutionizing financial infrastructure, with AI integration enhancing service offerings across DeFi platforms. AI integration enhances transaction efficiencies and security protocols, creating sophisticated trading strategies through enhanced protocols.

Perhaps most remarkably, projections suggest Bitcoin could potentially challenge USD dominance as a reserve currency by 2025—a prospect that would have seemed laughably absurd during crypto’s early years. With Bitcoin users projected to reach 1.1 billion by 2030, and nearly 25% of U.S. non-owners gaining trust from government crypto initiatives, the question isn’t whether mainstream adoption will occur, but rather how quickly traditional financial institutions will adapt to this new reality.